Frequently Asked Questions

You can donate through the donation forms in our Website which has been integerated with payment gateways which has payment options using UPI/Net Banking/Debit Cards/Credit Cards.

You can directly donate through a bank transfer(IMPS, NEFT & RTGS), Gpay/Phone/UPI or send us a cheque. Post the payment is done please send us your name/organisation name, contact number, PAN Details, e-mail ID along with “Transaction Reference” or “Screen shot” of the acknowledgement to aalyamselveerfoundation@gmail.com

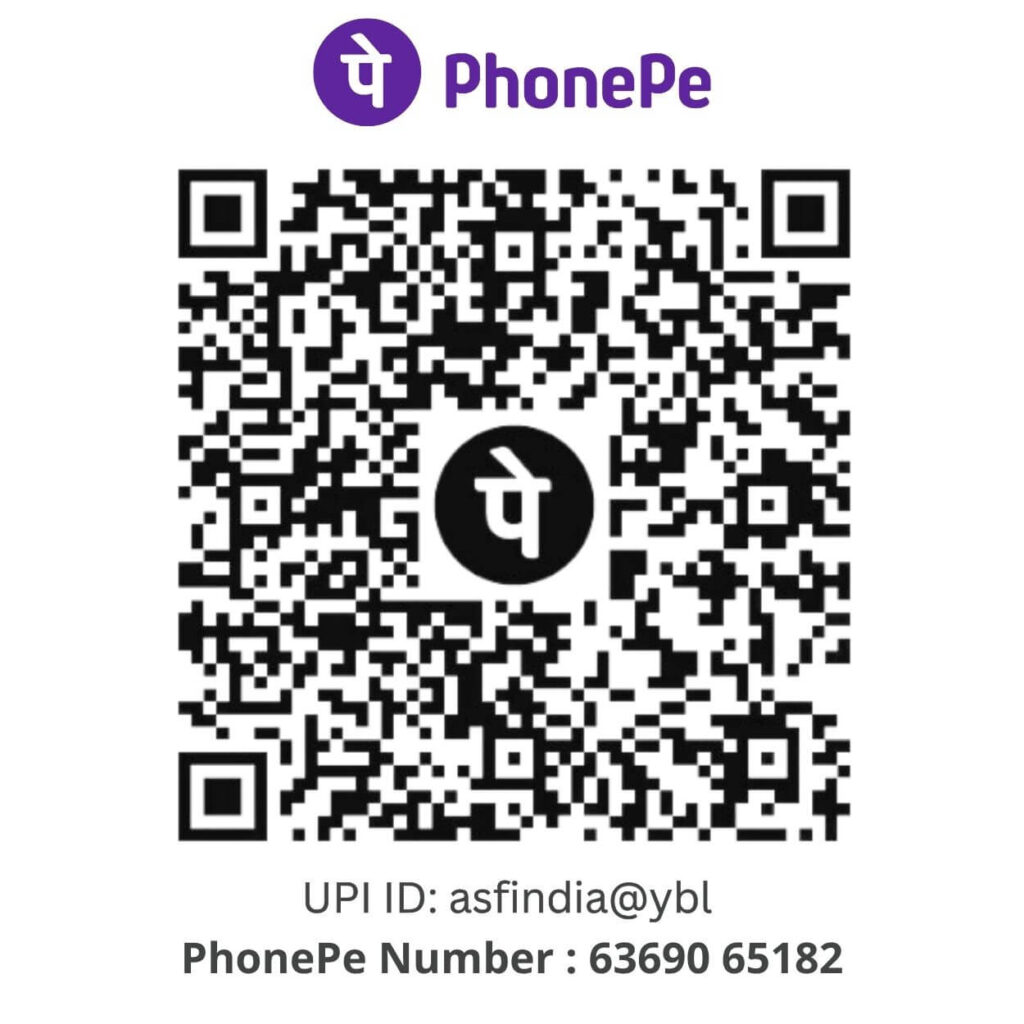

Our GPay/PhonePe/UPI/Bank Details:

you can GPay/PhonePe : 63690 65182 UPI IDs: asfindia@ybl (or) aalayamselveerfoundation@okhdfcbank

Bank Details:

Bank Name : HDFC Bank Limited

Current Account Name : Aalayam Selveer Foundation

Current Account number : 50200091594490

IFSC Code : HDFC0009638

Branch : 11th Avenue Ashok Nagar, Chennai, Tamil Nadu

Yes, all donations made to Aalayam Selveer Foundation are eligible for a 50% deduction from taxable income under section 80G of the Indian Income Tax Act. Click here to download our 80G Certificate

Yes, a digital copy of the donation receipt is generated on and sent to your Email/WhatsApp.

It will reach you within 24-48 hours through your Email/WhatsApp. In case you do not receive the receipt, please write to us at aalyamselveerfoundation@gmail.com

Yes, you can donate. But the tax exemption can be claimed only against the PAN details provided at checkout.

Yes, if you select the program name under donate ,your donation will be used for that respective program only. If you donate using the general donation category, your donations shall be directed to the program where the need is more.

At Aalayam Selveer Foundation, we maintain transparency in all our transactions. You can visit along with our volunteers to our distribution sites and see your contribution at work. Please write to us well in advance at aalyamselveerfoundation@gmail.com and we help you coordinate your distribution site visit.

No. We currently cannot accept donations from Foreign Donors as we do not have an FCRA registration.

Yes, all your online transactions in our website are secure, we have strict security measures in our website and we don’t store your Credit/Debit/Bank information on our website. All the payment gateways used in this website are third party payment gateway recognized and approved by the financial institutions under the Government of India.

Yes, we do accept donations in cash. However, if you like to avail of tax exemption for your donation, you can only contribute Rs 2000 cash in a financial year.

Please write to us at aalyamselveerfoundation@gmail.com and we will issue a duplicate receipt mentioning your donation details.

There is no specific amount that should be donated, you can either preselect the displayed amount in the donation form or enter any amount of your choice by clicking “Custom Amount”

We appreciate and accept donations of all sizes, as every contribution, irrespective of the amount, it significantly contributes to our collective efforts. There are no minimum or maximum donation limits. Your generosity makes a meaningful impact, regardless of the amount of your donation.

Aalayam Selveer Foundation is credible organization and we honour the privacy of our donors. Donor’s data is not exposed or shared with any external agency under any circumstances. The data is kept strictly confidential and only authorized staff with a special non-disclosure agreement have access to it.

Yes, it’s vital to retain the donation receipt for tax filing. Aalayam Selveer Foundation will provide you with a donation receipt confirming your contribution for claiming tax exemption on donation under section 80G of the Indian Income Tax Act.

No, to receive the tax exemption on your donations under section 80G of the Indian Income Tax Act, you must provide your personal information, including your PAN, as mandated by Income Tax regulations.

Aalayam Selveer Foundation has focusses on 5 key programs,

1. Annadhanam

2. Education Scholarship Program

3. Talent Scholarship Program

4. Help 2 Schools Program

5. Ancient Temples Uzhavarapani

Feeding food for the hungry and deprived is considered as an act of feeding the God. Our volunteers search and reach out to the hungry and provide them food and clean drinking water.

Currently we can do Annadhaanam at Chennai, Pudukottai and Nagapattinam. Based on the volunteers availability the location will be decided.

Aalayam Selveer Foundation’s Education Scholarship Program identifies and provide financial aid to the deserving school students who has excellent academic track record and a passion towards education, but currently at the risk of discontinuing their school education because of poverty.

You can download the policy document and application form in this link.

Aalayam Selveer Foundation’s Talent Scholarship Program identifies and provide financial aid to the deserving school students who has excellent track record and a passion towards sports and arts, but currently at the risk of discontinuing their passion because of poverty.

You can download the policy document and application form in this link.

Aalayam Selveer Foundation’s Help 2 Schools Program focuses on enhancing the quality of learning experience in the government schools by sponsoring projects in creating basic amenities and elevating the standards of government schools across Tamil Nadu.

You can download the policy document and application form in this link.

Identify historic ancient temples in remote places and undertake Uzhavarapani(temple cleaning), ensure the revival of daily poojas, contribution towards basic amenties, oil for pooja, other pooja related consumables, and planting flower saplings, etc.,

Aalayam Selveer Foundation is a Chennai based NGO registered under Section 8 of the Indian Companies Act, 2013, and Section 12A of the Income Tax Act, 1961.

“Aalayam Selveer” is a popular Tamil YouTube Channel with nearly 15.5 Lakhs Subscribers was found in the year 2018 by two first generation entrepreneurs and friends Parameswaran and Madhan, Aalayam Selveer does research and present videos about Ancient Hindu Temples, Siddhar Songs, Yoga, Siddha Medicine, Siddha Astrology, Traditional Arts & Crafts, and Ancient Way of Living so that our ancient wisdom and culture is carried forward to our future generations.

In 2020 “Aalayam Selveer” started its social welfare arm, through which it started spending a portion of it’s income on annadhanam, education of poor children and cleaning and rejuvenating ancient temples.

To make it bigger and reach out to more communities which are in need, Parameswaran and Madhan started “Aalayam Selveer Foundation” in December 2023(Unique ID of NGO: TN/2024/0381715 / Registration No: U88900TN2023NPL166072)

A Darpan ID is a unique identification number given to non-governmental organizations (NGOs) that register on the NGO Darpan portal administered by by Niti Aayog, Government of India. The Darpan portal is a government-run website that helps NGOs create a repository of information and become more transparent. As per the prevention of Money Laundering (Maintenance of Records) Amendment Rules, 2023, all Financial Institutes have been mandated to ensure NPO DARPAN Unique ID for NPOs for opening and operating accounts in any Bank. Similarly, DARPAN Unique ID is also required for registration/renewal of Foreign Contribution (Regulation) Act, seeking tax exemptions under 80-G of Income Tax.

Yes, our Darpan ID is TN/2024/0381715 and Darpan Registration Date is 17-01-2024.

Yes, Aalayam Selveer Foundation is registered with Registrar of Companies under Section 8 of the Indian Companies Act, 2013, and Section 12A of the Income Tax Act, 1961 with the Registration No: U88900TN2023NPL166072, with the date of registration: 20-12-2023. Click here to down load our Certificate of Incorporation.

We have received immense support from numerous individuals, private and public sector companies, trusts/NGOs, educational institutions, public figures and the mass media. One can associate with us in any of our programs either by donating or becoming a volunteer. Please visit “Become a Volunteer” section of our website for more information on the possible ways of being involved in our journey.

Yes, Corporates can associate with us for any ongoing programs through their Corporate Social Responsibility (CSR) initiatives. At Aalayam Selveer Foundation we welcome powerful collaboration with Corporate hosues which are dedicated to make a meaningful impact in our society. We believe that the true progress is achieved when communities, organizations, and individuals come together to uplift the marginalized and vulnerable.

You can get in touch with us through our email aalyamselveerfoundation@gmail.com or WhatsApp at 6369065182 or you can call our administrative office at 04449580123 (Mon – Sat, 10 AM to 5 PM)

You can subscribe and follow our social media channels, or visit our website regularly to stay informed about our latest initiatives, success stories, ongoing projects and upcoming projects.

What can we help you find?

Search about our project details, project completed, FAQs

How to donate?

You can donate through the donation forms in our Website which has been integerated with payment gateways which has payment options using UPI/Net Banking/Debit Cards/Credit Cards Or you can directly donate through a bank transfer(IMPS, NEFT & RTGS) to our bank account, Gpay/Phone/UPI or send us a cheque.

GPay/PhonePe/UPI Details:

GPay : 63690 65182

PhonePe : 63690 65182

UPI IDs: asfindia@ybl

aalayamselveerfoundation@okhdfcbank

aalayamselveerfoundation@upi

Bank Details:

Bank Name : HDFC Bank Limited

A/C Name : Aalayam Selveer Foundation

Current Account No : 50200091594490

IFSC Code : HDFC0009638

Branch : 11th Avenue Ashok Nagar, Chennai

Scan with any UPI App

We Can Change Everything Together! Get Connected

044 49580123

Our Volunteers